60/40 Portfolio

Status: Alive

Full Name: 60/40 Portfolio

Date of Birth: Not applicable

Date of Death: Not applicable

How old is/was 60/40 Portfolio?: Not applicable

Nationality: Not applicable

Category: Investor

Last Update: March, 25, 2025

Latest Activity: Recent analysis suggests the 60/40 portfolio remains a viable investment strategy – March, 25, 2025 (View Article)

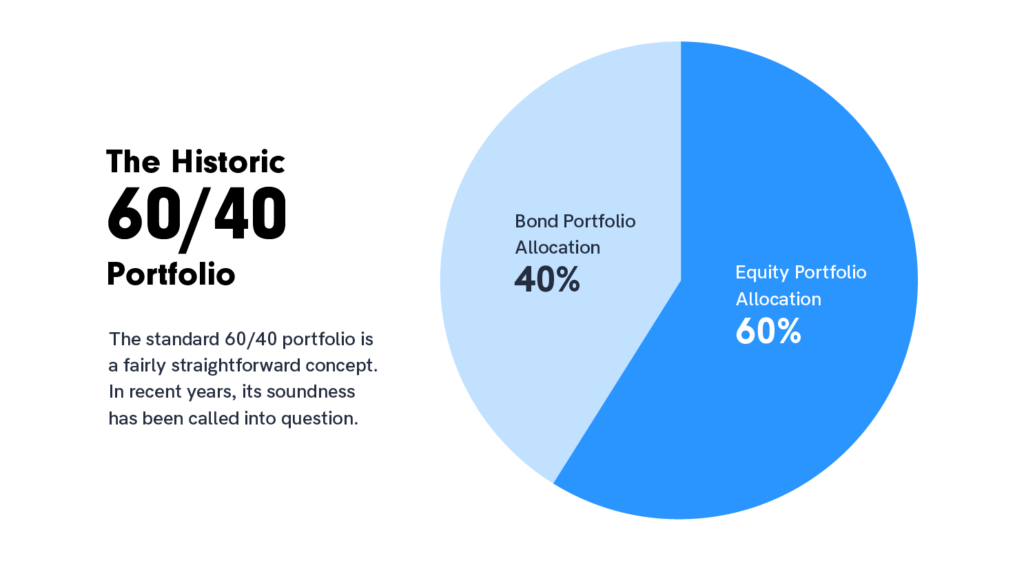

Latest Picture:60/40 Portfolio Illustration

Status Notes

Is the 60/40 portfolio dead? It’s an investment strategy known for balancing risk and reward. The 60/40 portfolio, which allocates 60% to stocks and 40% to bonds, has been a staple for investors seeking a balanced approach to wealth management.

Despite recent market volatility, the 60/40 portfolio has shown resilience and adaptability. Financial experts continue to recommend it as a core component of diversified investment portfolios.

Recent studies have shown that the 60/40 portfolio can still provide competitive returns while mitigating risk. Morningstar highlights its enduring relevance in today’s market environment.

The 60/40 portfolio’s health status remains strong, with many investors still finding value in its balanced approach. It continues to be a popular choice for those seeking long-term growth and stability.

While some alternative strategies have gained popularity, the 60/40 portfolio’s death rumors have been greatly exaggerated. It remains a viable option for investors looking to navigate the complexities of the financial markets.

The 60/40 portfolio’s resilience can be attributed to its ability to adapt to changing market conditions. By rebalancing and adjusting asset allocations, investors can maintain the portfolio’s intended risk-reward profile.

In comparison to other investment strategies like the all-equity portfolio or the risk parity approach, the 60/40 portfolio offers a unique balance. It provides exposure to both growth and income-generating assets, making it suitable for a wide range of investors.

The 60/40 portfolio’s longevity can be attributed to its simplicity and effectiveness. By maintaining a disciplined approach to asset allocation, investors can benefit from the portfolio’s long-term performance.

As the financial landscape evolves, the 60/40 portfolio continues to adapt. Investors can customize their allocations based on their risk tolerance and investment goals, ensuring the portfolio remains relevant in today’s market.

The 60/40 portfolio’s health status is a testament to its enduring appeal. It remains a cornerstone of many investors’ portfolios, providing a solid foundation for long-term wealth accumulation.

Rumors

Recent rumors have suggested that the 60/40 portfolio is no longer effective in today’s market environment. However, these claims have been largely debunked by financial experts.

The origins of these rumors can be traced back to periods of heightened market volatility. During such times, the 60/40 portfolio may experience short-term fluctuations, leading some to question its viability.

However, a closer examination of the portfolio’s long-term performance reveals its resilience. CNBC reports that the 60/40 portfolio has consistently delivered competitive returns over extended periods.

The 60/40 portfolio’s health status remains strong, with many investors still finding value in its balanced approach. It continues to be a popular choice for those seeking long-term growth and stability.

While some alternative strategies have gained popularity, the 60/40 portfolio’s death rumors have been greatly exaggerated. It remains a viable option for investors looking to navigate the complexities of the financial markets.

The 60/40 portfolio’s resilience can be attributed to its ability to adapt to changing market conditions. By rebalancing and adjusting asset allocations, investors can maintain the portfolio’s intended risk-reward profile.

In comparison to other investment strategies like the all-equity portfolio or the risk parity approach, the 60/40 portfolio offers a unique balance. It provides exposure to both growth and income-generating assets, making it suitable for a wide range of investors.

The 60/40 portfolio’s longevity can be attributed to its simplicity and effectiveness. By maintaining a disciplined approach to asset allocation, investors can benefit from the portfolio’s long-term performance.

As the financial landscape evolves, the 60/40 portfolio continues to adapt. Investors can customize their allocations based on their risk tolerance and investment goals, ensuring the portfolio remains relevant in today’s market.

The 60/40 portfolio’s health status is a testament to its enduring appeal. It remains a cornerstone of many investors’ portfolios, providing a solid foundation for long-term wealth accumulation.

Social Media Links

Instagram: Not available

X: Not available

Facebook: Not available

TikTok: Not available

Data & Sources

Data is sourced from trusted financial analysis and credible news like Investopedia, tracked in real-time by our team, last verified March, 25, 2025. Learn more on our About page. Note that delays or discrepancies may occur—cross-check with links.

Related Articles & Media

The 60/40 Portfolio Is Not Dead – Morningstar

The 60/40 Portfolio Is Not Dead – CNBC

Does the 60/40 Portfolio Model Still Work? – Investopedia

- Is Bob from Bob’s Furniture Dead? Status Update as of April, 15, 2025 - April 15, 2025

- Is Terry Flenory Dead? Status Update as of April, 15, 2025 - April 15, 2025

- Is Nikko Jenkins Dead? Status Update as of April, 15, 2025 - April 15, 2025